In the global effort to combact climate change, carbon markets have become a crucial mechanism for promoting carbon neutrality. Carbon markets are divided into two main types: compliance carbon markets and voluntary carbon market. They play a vital role in reducing greenhouse gas emissions and supporting sustainable development.

1. Concept and Background of the Carbon Market

A carbon market is an economic mechanism that transforms carbon emissions into tradable assets (such as carbon allowances or carbon credits), which incentivizes governments and businesses to implement carbon reduction or carbon removal measures. The origins of carbon markets trace back to the Kyoto Protocol in 1997, which established a global carbon trading mechanism for the first time. This lays the foundation for early carbon markets. At present, carbon markets have developed into two main categories: compliance carbon market and voluntary carbon market. The key differences between the two lie in the binding nature of participation, allowance allocation methods, and regulatory mechanism.

- Carbon Emission Reduction: Decreasing greenhouse gas (GHG) release through methods like improving energy efficiency or using clean energy.

- Carbon Removal: Capturing and removing CO2 already in the atmosphere through methods like afforestation or carbon capture and storage (CCS).

2. Compliance Carbon Market

The compliance carbon market is typically government-led and established based on legal or regulatory requirements, aiming to reduce greenhouse gas emissions through compulsory measures. It requires specific industries or companies to comply with emission quotas or carbon tax systems. The market targets specific industries with high emissions, such as power generation, steel, cement, and chemicals.

2.1 Operating Mechanism

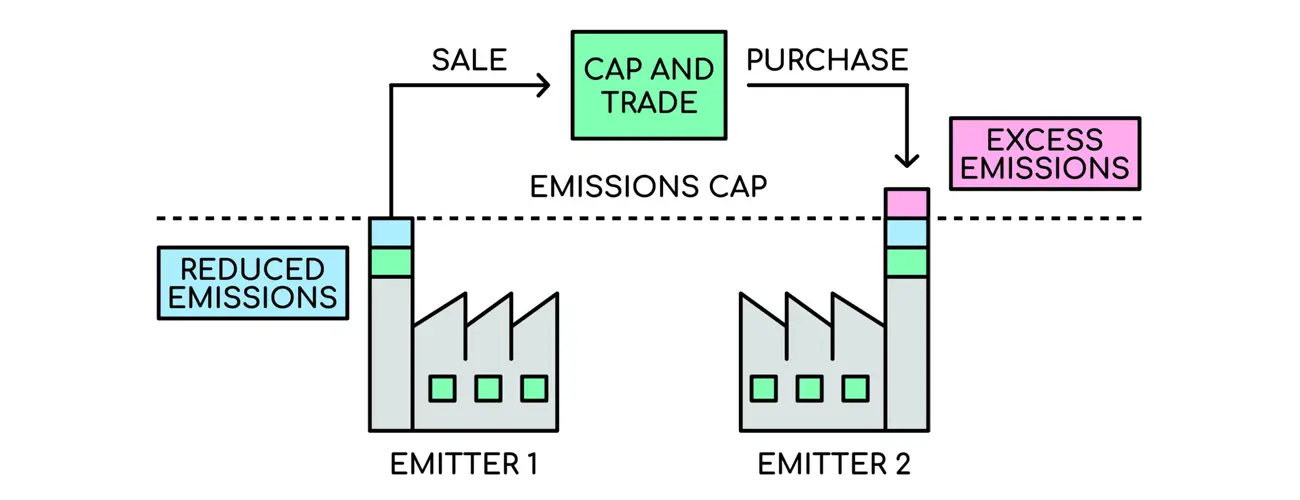

Governments set an overall emissions cap and allocate allowances to emitters. If a company exceeds its allowance, it must purchase additional allowances from other companies; if it emits less, it can sell surplus allowances.

2.2 Key Examples

- European Union Emissions Trading System (EU ETS): The largest carbon market in the world, covering multiple high-emission sectors. By gradually reducing the number of allowances each year, the EU ETS has effectively driven greenhouse gas reductions across Europe.

- China’s Carbon Market: The largest carbon market globally, initially covering the power sector, with plans to expand to additional industries. China’s market uses a combination of allowance auctions and allocations to promote emission reduction targets.

- California Carbon Market: One of the largest carbon markets in the United States, involving sectors such as power and industry. It is linked with Quebec’s carbon market in Canada, forming a cross-border trading system.

3. Voluntary Carbon Market

The voluntary carbon market (VCM) is a market where businesses, organizations, or individuals voluntarily purchase carbon credits to offset their carbon emissions without legal mandate. It depends more on the proactive actions of participants, motivated by factors such as social responsibility (CSR), brand value, and supply chain requirements.

3.1 Operating Mechanism

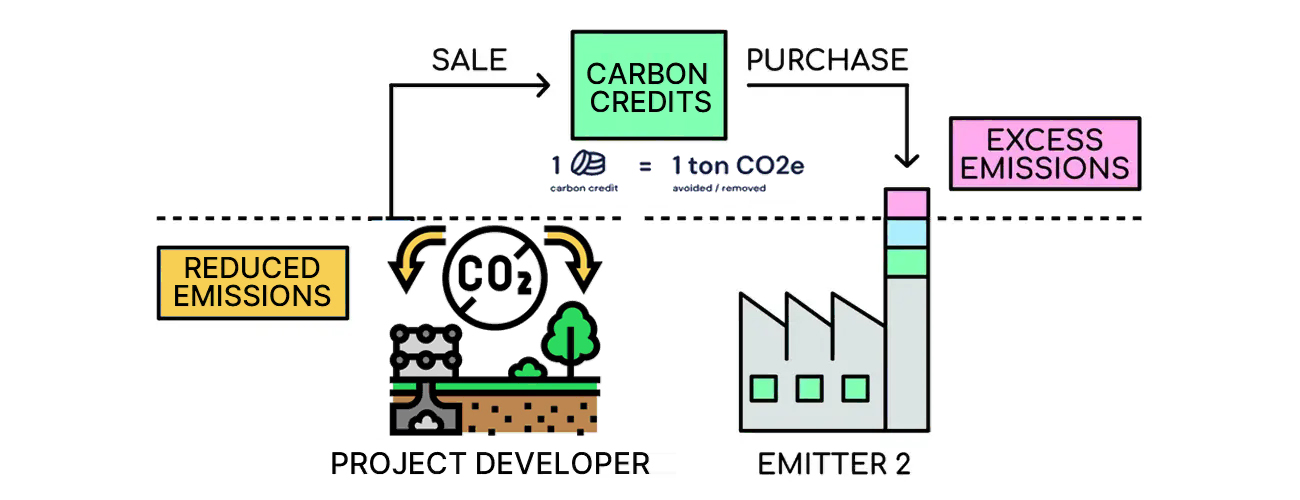

In the voluntary carbon market, each carbon credit represents the reduction or removal of one ton of greenhouse gases. This typically achieved through projects such as afforestation, clean energy development, biochar carbon sequestration, and direct air capture (DAC). Participants purchase carbon credits to proactively offset their own emissions, thereby achieving carbon neutrality. Carbon credits are usually verified by third-party certification standards, such as Verified Carbon Standard (VCS) or Gold Standard, to ensure authenticity and validity.

3.2 Key Examples

Major technology companies such as Microsoft, Google, and Apple have all pledged to purchase carbon credits to offset the emissions they generate.

4. How Compliance & Voluntary Carbon Markets Drive Carbon Neutrality

Carbon neutrality refers to achieving net-zero emissions by maximizing emission reductions while combining necessary carbon removal or offsetting measures. In this process, mandatory and voluntary carbon markets are not substitutes, but rather complementary mechanisms that together form a comprehensive carbon mitigation system.

Mandatory Carbon Markets: Driving “Emissions That Must Happen

Reduce Emissions at the Source via Strict Regulation

Governments set emissions caps for high-emission sectors through legal and regulatory measures, progressively tightening the total allowance over time. This ensures a sustained decline in carbon emissions at the macro level and supports the achievement of carbon neutrality goals.

Incentivize Corporate Transformation via Carbon Pricing

Trading of carbon allowances creates a carbon price, turning emissions into a quantifiable business cost. As a result, companies are compelled to reduce emission intensity by improving energy efficiency, optimizing production processes, adjusting energy mixes, or adopting low-carbon technologies.

Voluntary Carbon Markets: Addressing “Temporarily Unavoidable Emissions”

Offer Solution for Hard-to-abate Residual Emissions

Even under stringent emission reduction scenarios, certain emissions remain: those that are technically difficult to eliminate or extremely costly and impossible to remove in the short term. Voluntary carbon markets allow companies to achieve net-zero commitments in the near term by purchasing high-quality carbon credits, while buying time for long-term technological breakthroughs.

Promote Development of Carbon Removal Technologies

Many carbon removal projects, such as Direct Air Capture (DAC), are currently expensive and not yet commercially mature. Voluntary carbon markets, through Advance Market Commitments (AMCs), provide early demand signals and funding support for these technologies, accelerating commercialization and contributing to the achievement of carbon neutrality.

6. Market Integration and Synergy: Advancing Carbon Neutrality

Currently, carbon markets are showing a clear trend of integration. Compliance carbon market continues to enforce the “hard constraints” necessary that drives emission reductions, while voluntary carbon markets are increasingly focusing on high-quality, auditable, and long-term storage projects, with carbon removal becoming an important part. This integration is expected to accelerate the development of low-carbon technologies and accelerate global progress toward carbon neutrality.